How to Improve Cash Flow in a Service Business

Money in the bank lets your field service respond to business opportunities and emergencies swiftly and effectively. And a high cash-to-receivables ratio puts you in a stronger position when borrowing funds to replace equipment or expand. There is no question robust cash flow is essential to your company's profitability and growth.

Jul 08, 2015

# of Minutes to Read

There is no question robust cash flow is essential to your company’s profitability and growth. Money in the bank lets your field service respond to business opportunities and emergencies swiftly and effectively. And a high cash-to-receivables ratio puts you in a stronger position when borrowing funds to replace equipment or expand. By collecting as quickly as possible and stretching your payables to the limit, you can increase your agility without changing your balance sheet. Here are some tips.

Improve your customer payment cycle

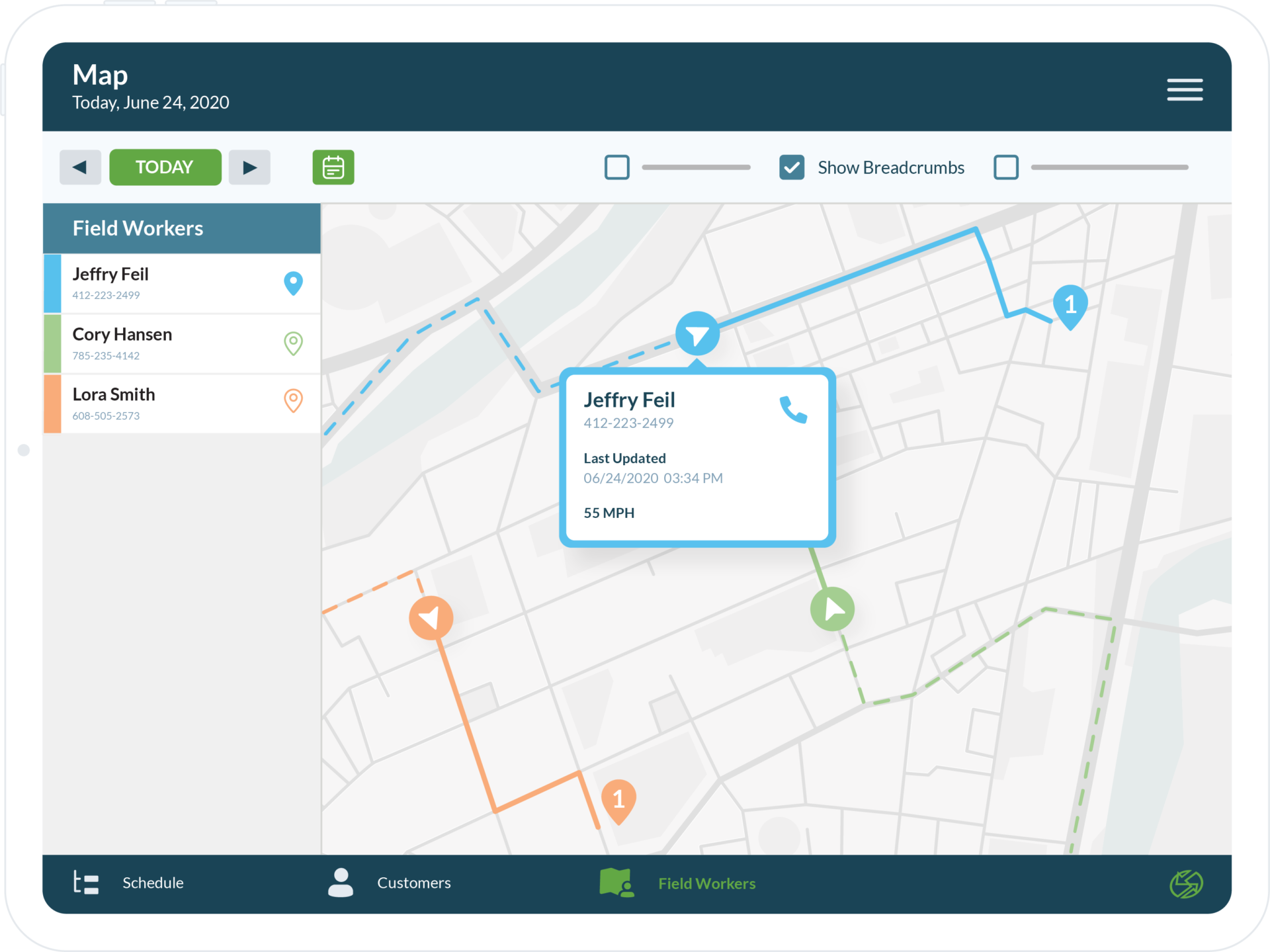

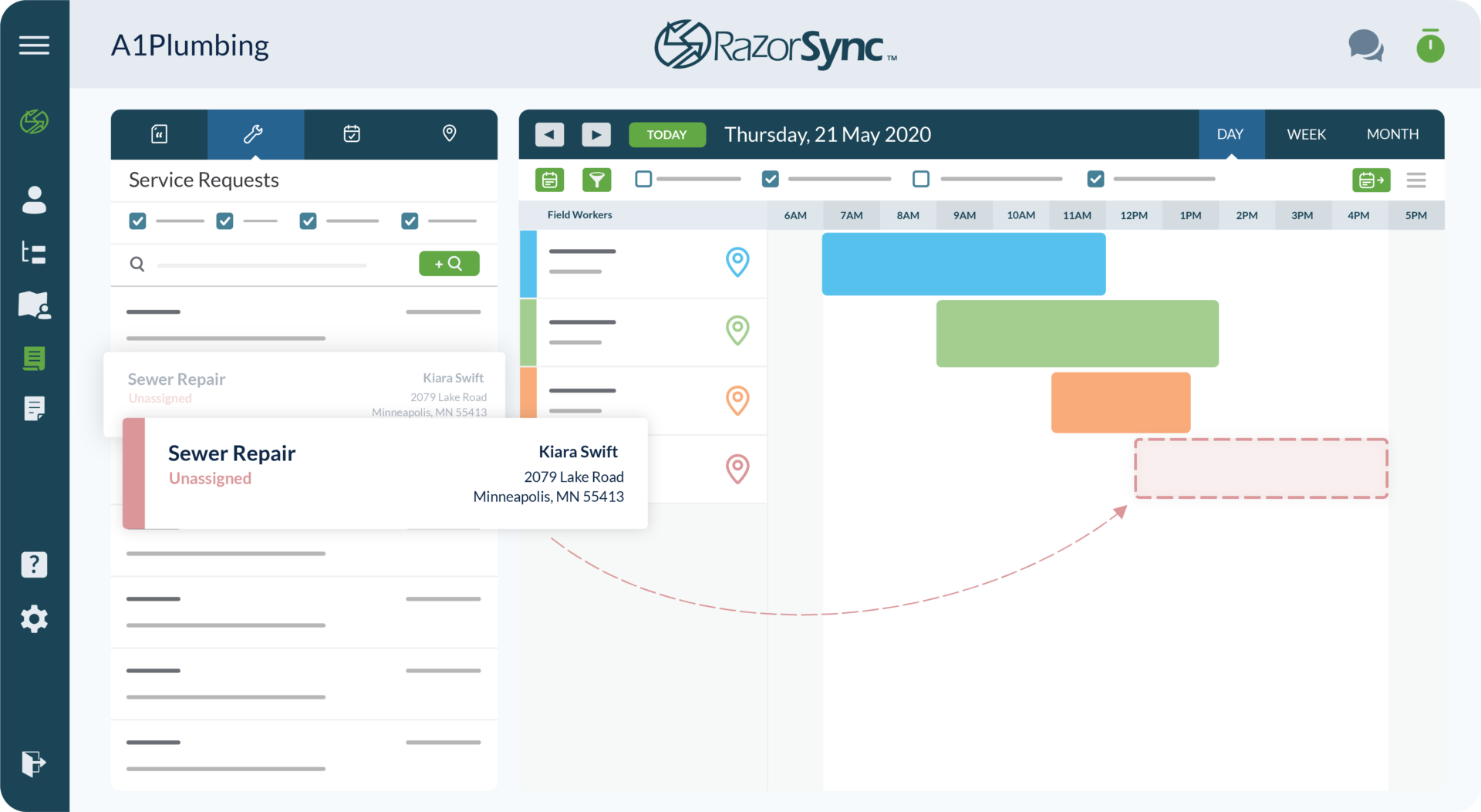

Make it a priority to convert invoices to cash as soon as possible – even before your trucks return at the end of the day. Make sure your field staff understands that this is a company goal.

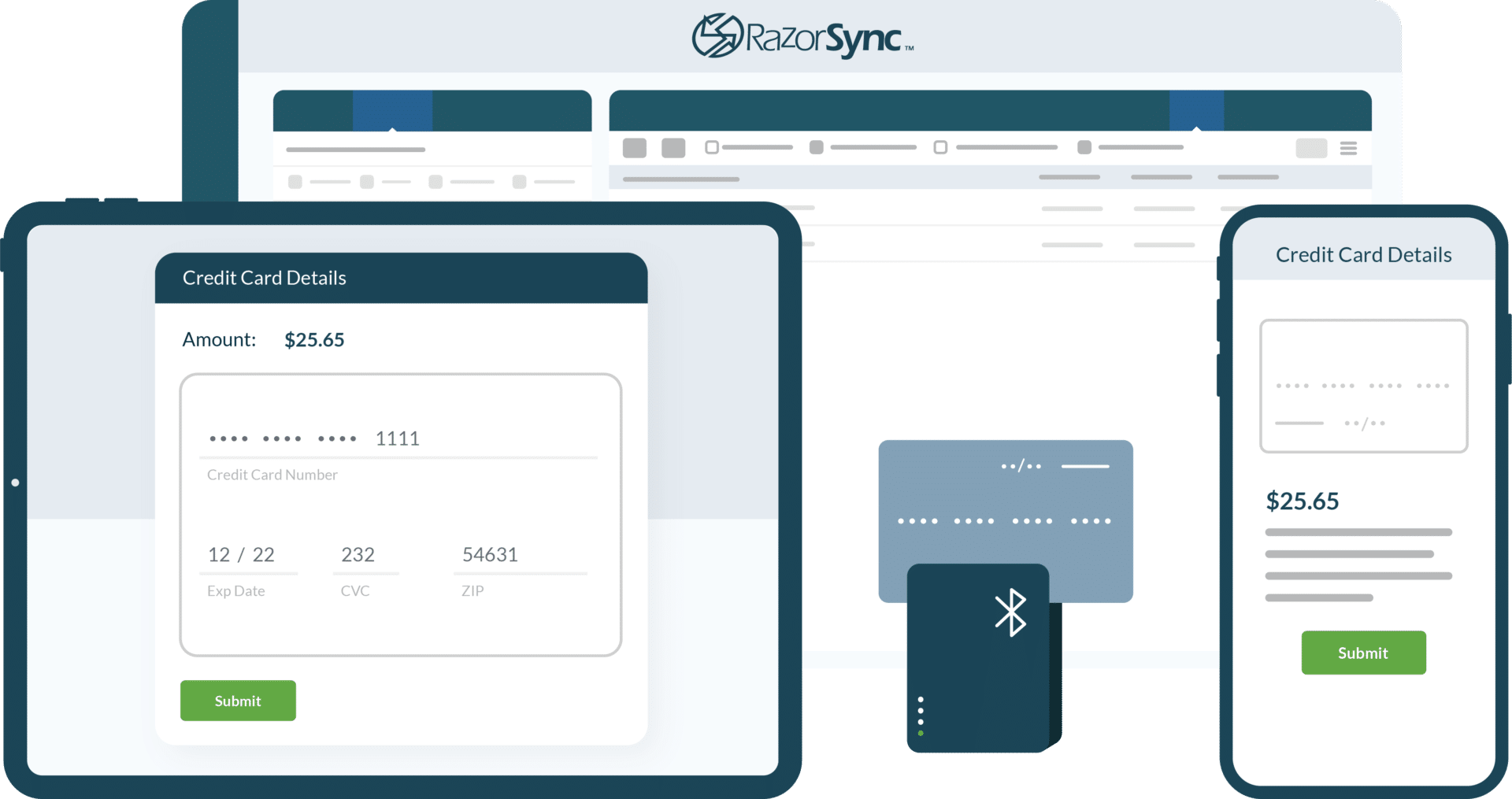

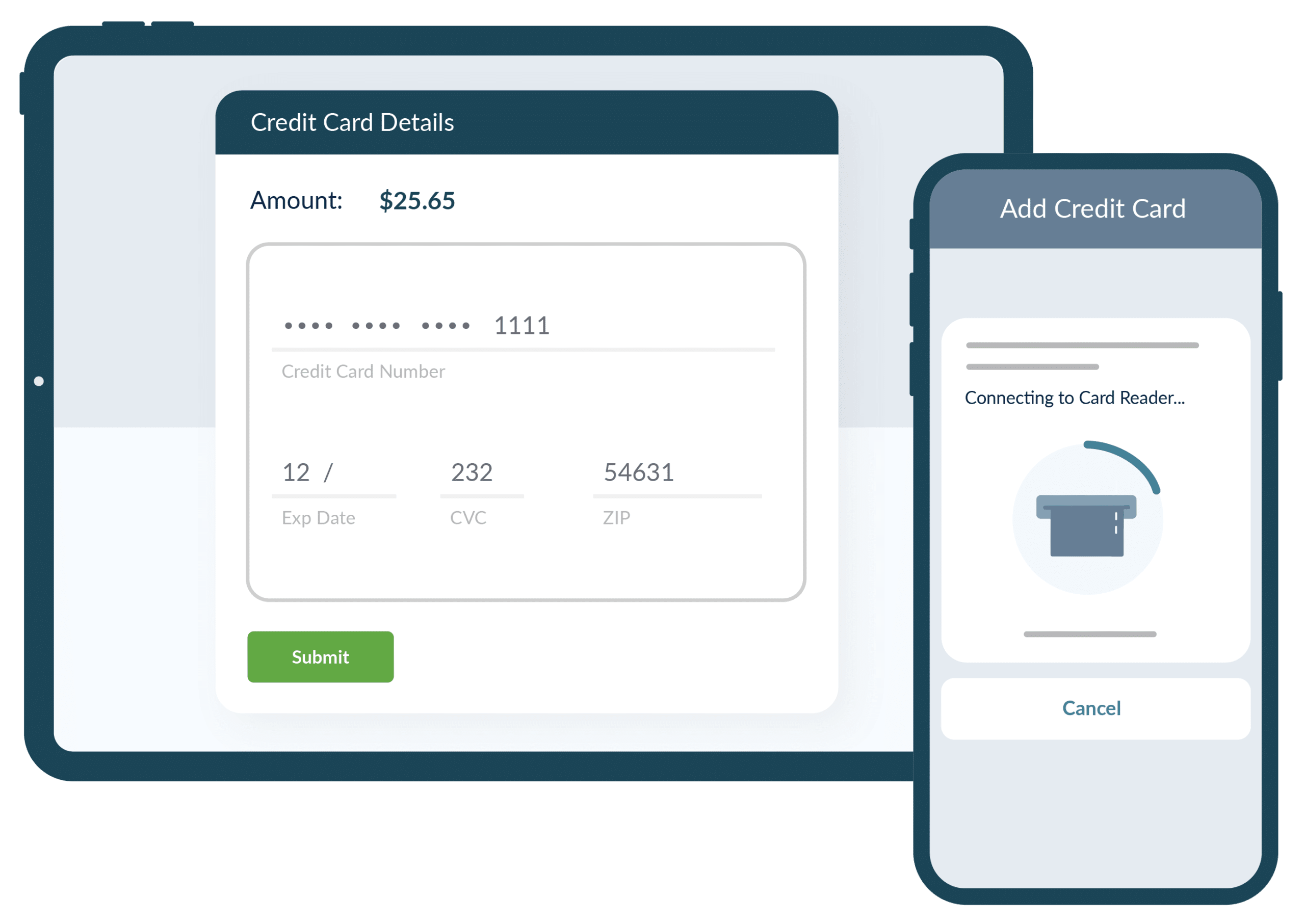

For single-visit work orders, aim for on-site payments. Equip your field workers with mobile field management software and card readers. Credit and debit card payments can be updated to customer accounts in QuickBooks before your trucks get home. Consider incentives for field staff with the highest percentages of on-site payments.

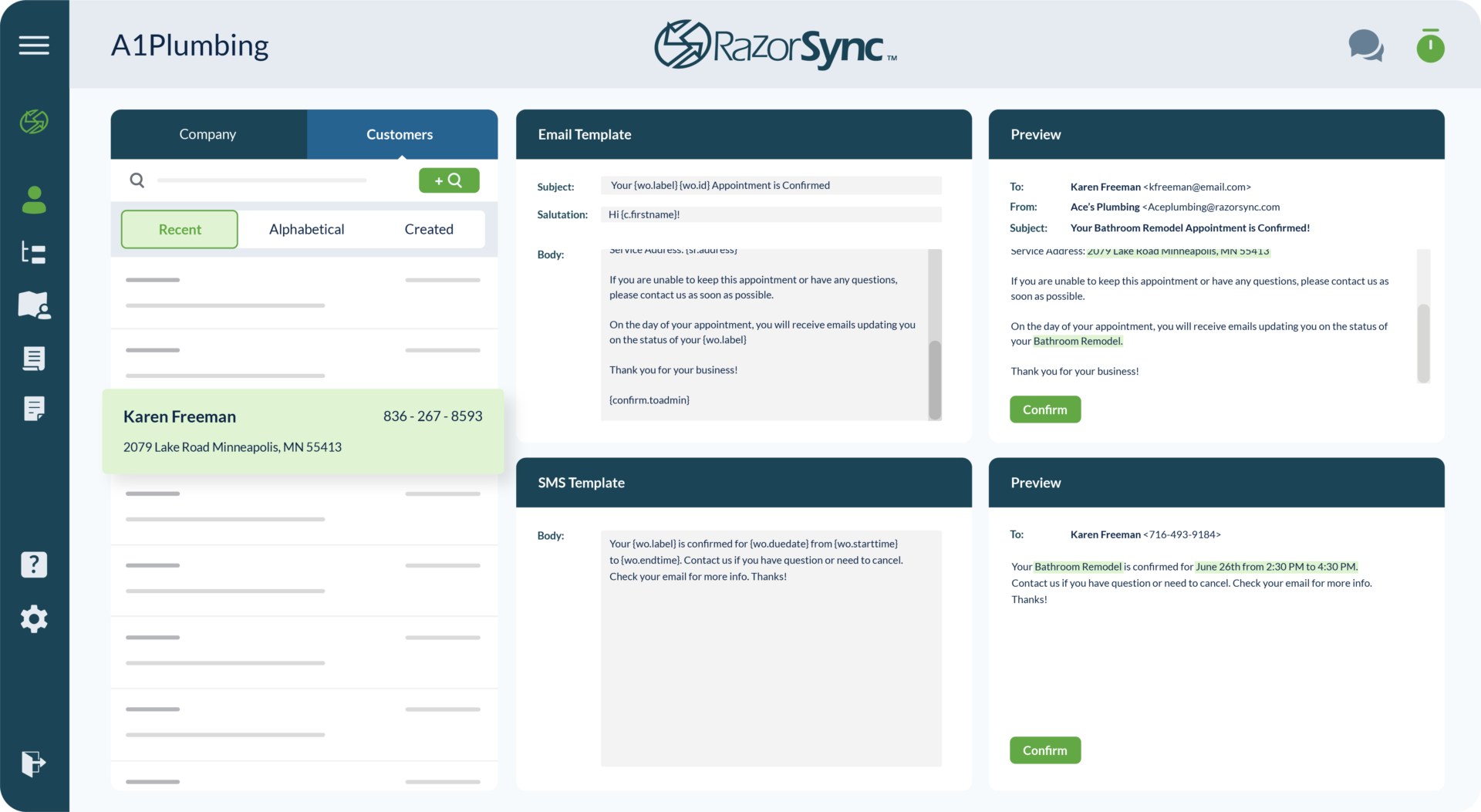

For those accounts where job-site payment is not the answer, you can still optimize the payment cycle with job-site invoicing. Have your field workers capture customer signatures on completion of all jobs, then email itemized invoices to the customers before the trucks leave the job sites. Not only does this push your invoices to the top of customers’ accounts payable lists, it will minimize the billing questions and disputes that bog down your bookkeeping office and the payment cycle.

Negotiate payment terms for each account, with discounts for early payment. Create a custom invoice template for each account, prominently featuring payment terms. Make a cheerful reminder call or send an email BEFORE the bill is due, identifying and resolving any dispute that might hold up payment. (This is an excellent opportunity to evaluate your customer service.)

Identify habitual problem payers. Your accounts receivables manager should be on a first-name basis with those customers / accounts-payable managers, relentlessly but gently working to bring them back into range. Track progress over a few months and be sure the accounts are improving. If not, determine whether you are actually making money on that business. You may have to fire the customer.

Stretch your payables and inventory until they squeak

Separate your regular suppliers from one-offs, then negotiate better terms and discounts with your regulars. Fine tune your payables so you stay just within terms. Examine your inventory to ensure you don’t have a lot of cash tied up in big-ticket items that are readily available on short order. If you find any aging big-ticket items in the warehouse, encourage your staff to push them at discounted prices.

At RazorSync, we are committed to helping our customers achieve higher profits with less stress. Do you have any tips for our users? Leave a comment below.