3 Ways Payment Processing Can Help Grow Your Field Service Business

Optimizing the way your team interacts with your customers and increasing company revenue are important steps to growing your business. When you automate your payment...

Oct 14, 2022

# of Minutes to Read

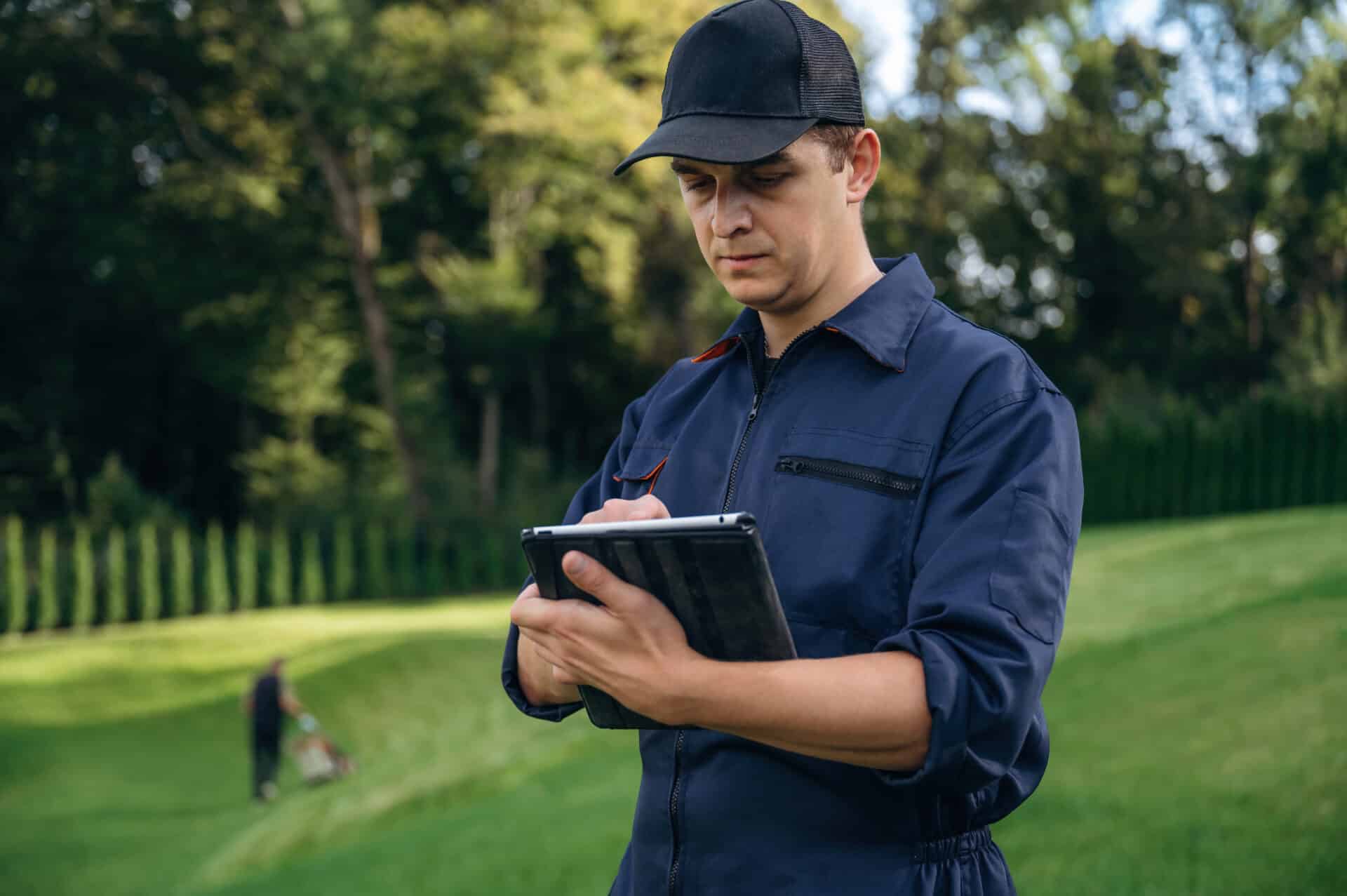

Optimizing the way your team interacts with your customers and increasing company revenue are important steps to growing your business. When you automate your payment processing, you can improve your business’s day-to-day operations both out in the field and back in the office! Payment processing with field service software allows you to increase job volume, shorten billing cycles and easily update customer records.

Below are 3 ways payment processing can help you grow your field service business:

Customer Satisfaction

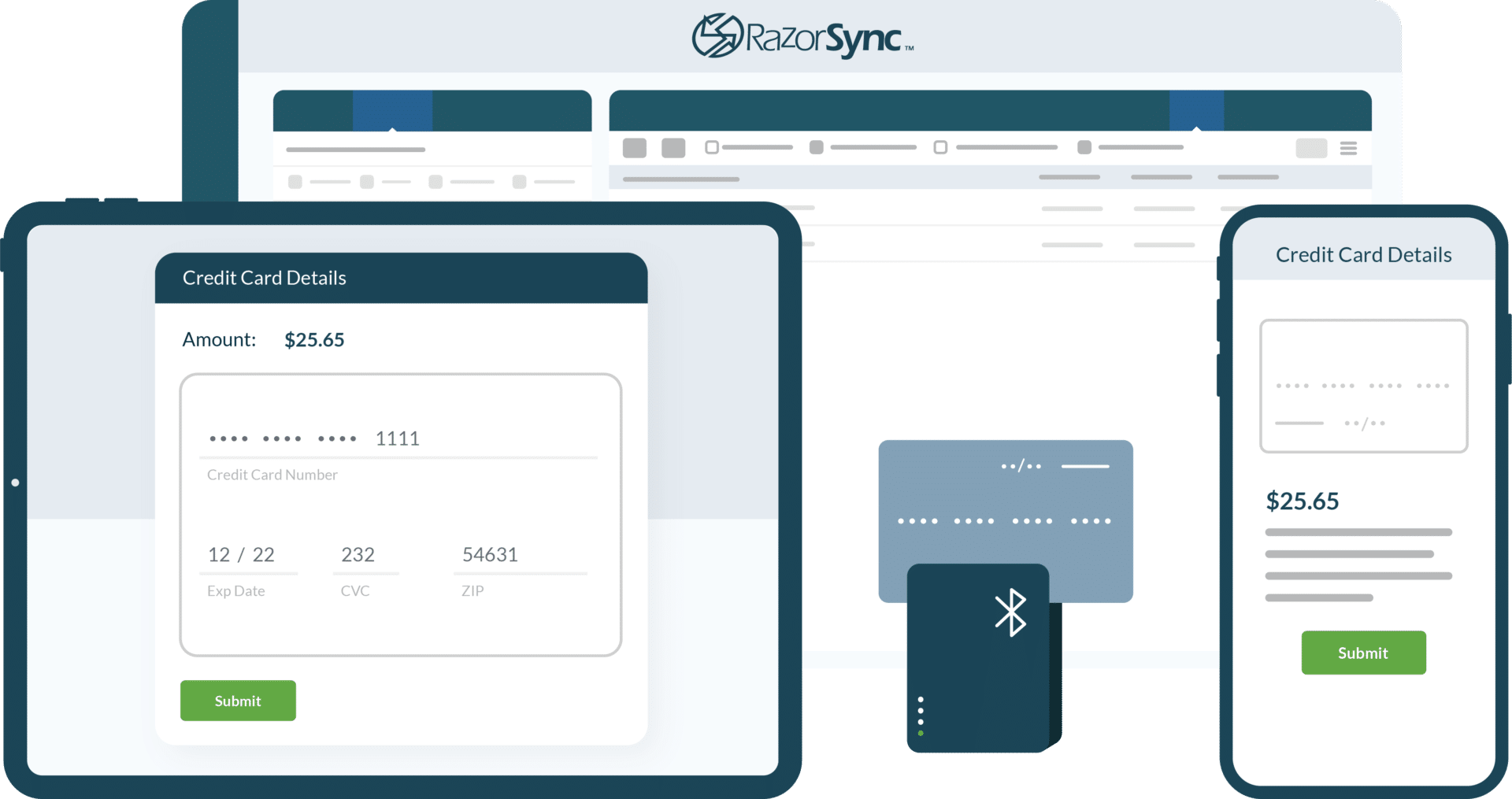

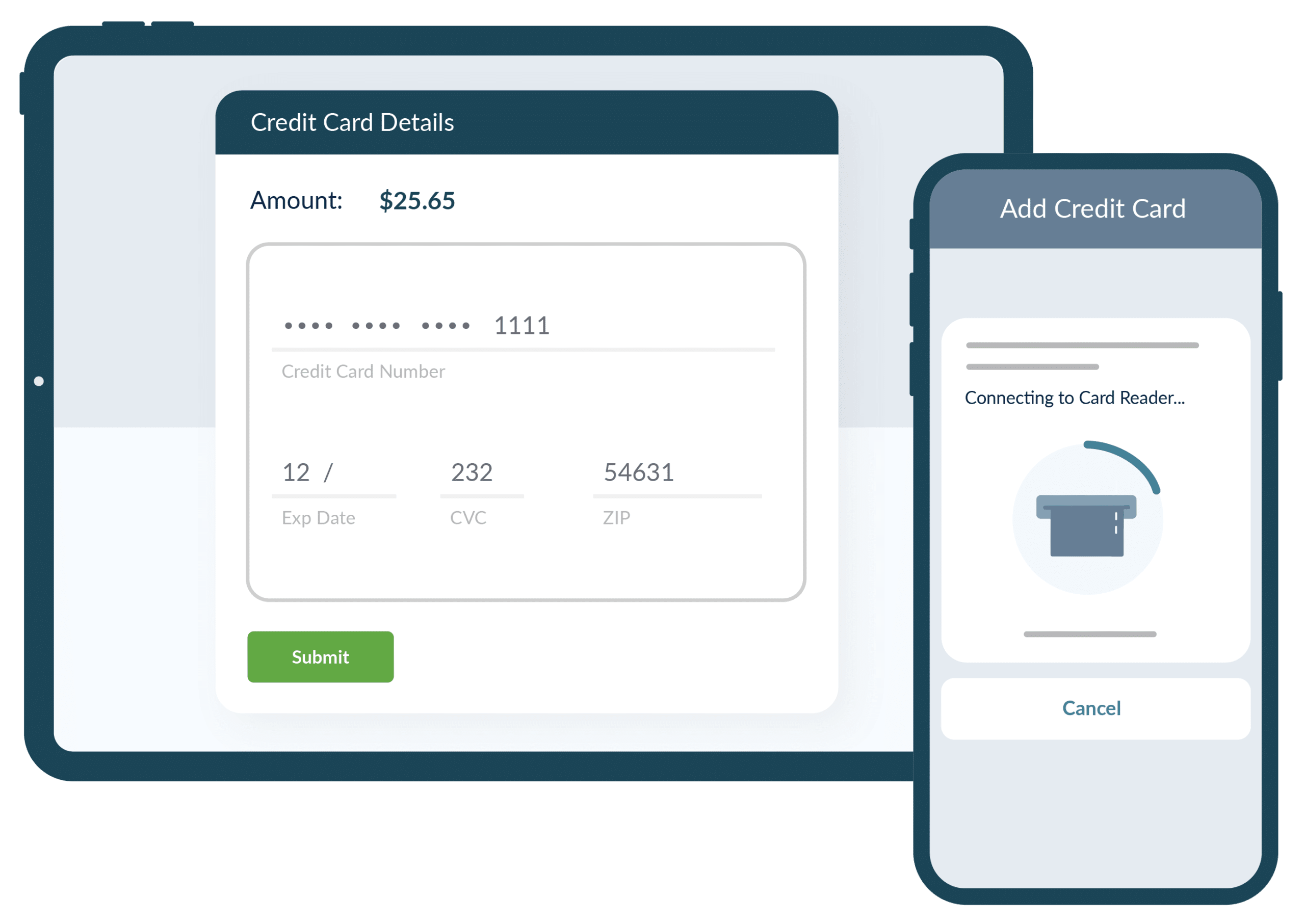

Accepting payments in the field via tablet or mobile software helps improve the customer experience. During times such as these, having the option to complete low-contact payments not only ensures the health of your team and your customers but allows for the payment process to be much less time-consuming: focusing more on the customer relationship. Meeting with the customer before or after the job is complete gives your technicians one-on-one time with each client.

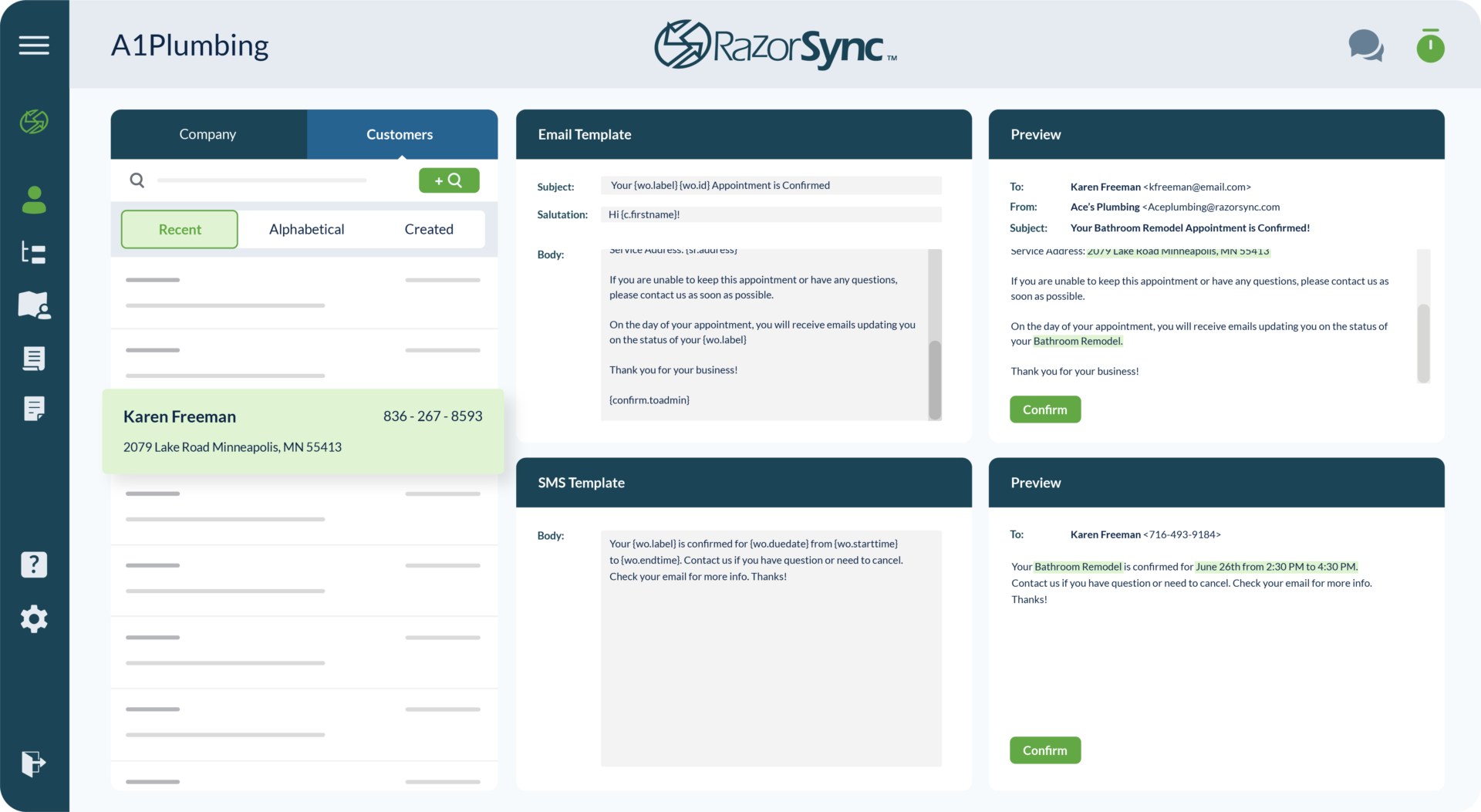

With mobile payment processing, your employees have more time to go over what the client is paying for while they pay for it in the field. The customer will also benefit from knowing his or her data is easy to find. Mobile payment processing keeps track of all payment records, which are then easy to sort through for later jobs. If a customer calls and has a question about their project or how much they paid, you and your team can quickly find their data and answer their questions.

Revenue Recovery

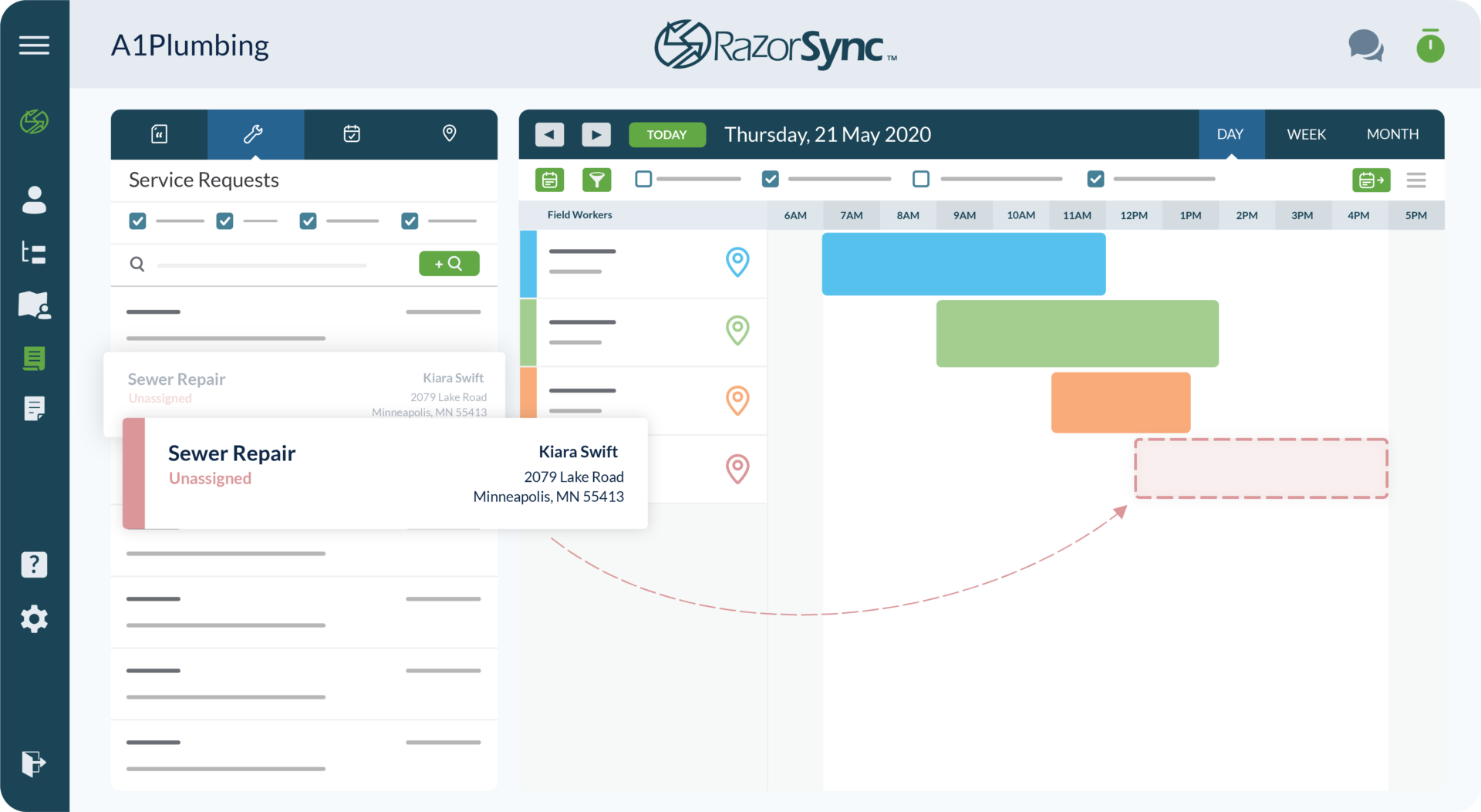

Of all the benefits of using mobile payment systems when working in the field, perhaps the most significant is that it speeds up the collection timeline. Instead of returning to the office to review completed jobs, put together invoices, then mail or email them to the customers, technicians can ask for payment as soon as they complete the job.

Since RazorSync integrates with payment platforms such as Quickbooks, your team can send PDF and Excel versions of invoices to customers directly from the job site. Field service businesses generally rely heavily on cash flow and revenue, therefore mobile payments help speed up the gap between service completion and payment, making financial planning more doable.

Job Planning

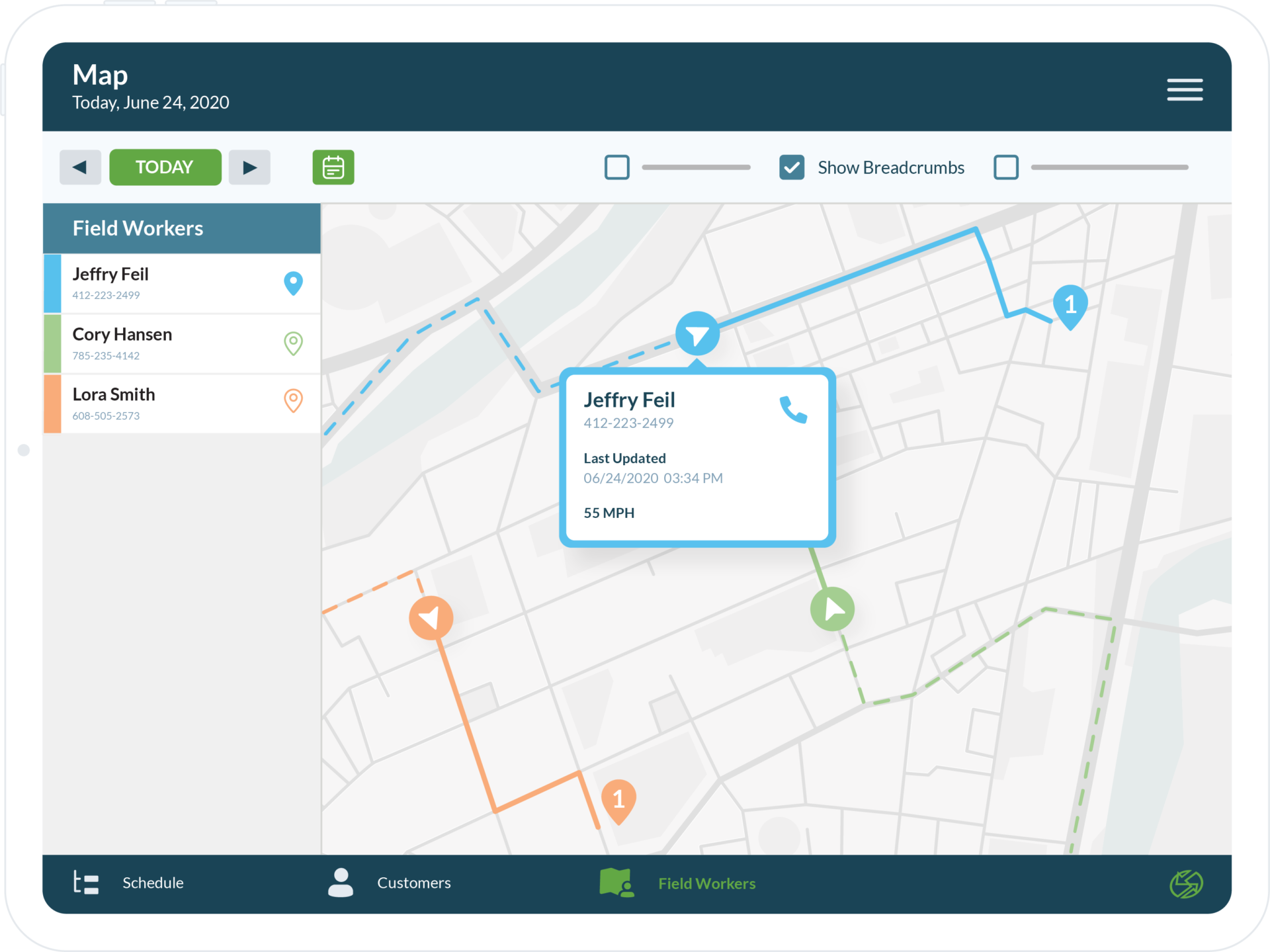

With mobile payment processing, your team can free up space in the day to handle more pressing matters. This allows for new job opportunities and also allows your employees to handle tasks that may have been put on the back burner. Payment processing software gives your team more time and energy to put into future business planning.

With this extra space in your day, take the time to set or reevaluate your business goals. Businesses with drawn-out business plans benefit more as their company progresses. Research more into your company’s industry and market to help prepare for the future. Look into your finances, are you where you need to be? Take a deep dive into your inventory, is everything up to date? Maybe your team needs to invest time in personnel planning as your business continues to grow. With mobile payment processing, your business can get back on track to succeed.

Ready to grow your business with the industry’s #1-rated payment processing app? Try RazorSync free for 14-days to get started! For more information, contact one of our pros to learn more.