Tax Tips for Your Small Service Business

January is a busy time for HVAC companies, plumbers, snow removal services and service businesses not affected by seasonal trends. And you know what is coming just down the road...

Dec 31, 2014

# of Minutes to Read

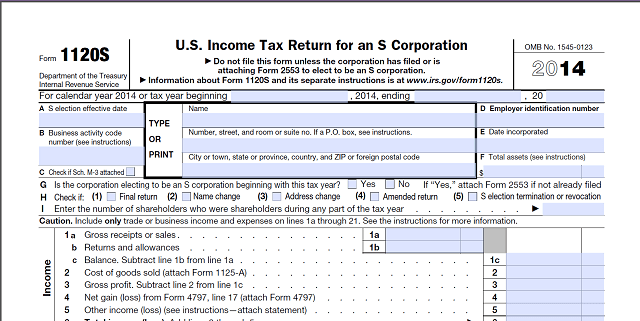

January is a busy time for HVAC companies, plumbers, snow removal services and service businesses not affected by seasonal trends. And you know what is coming just down the road—tax time. Here are a few tips to help you navigate the process smoothly, avoid an audit, and minimize the bite taxes takes out of your bottom line. It’s also time to plan for next year, arranging business operations to take advantage of qualifying tax credits and other benefits.

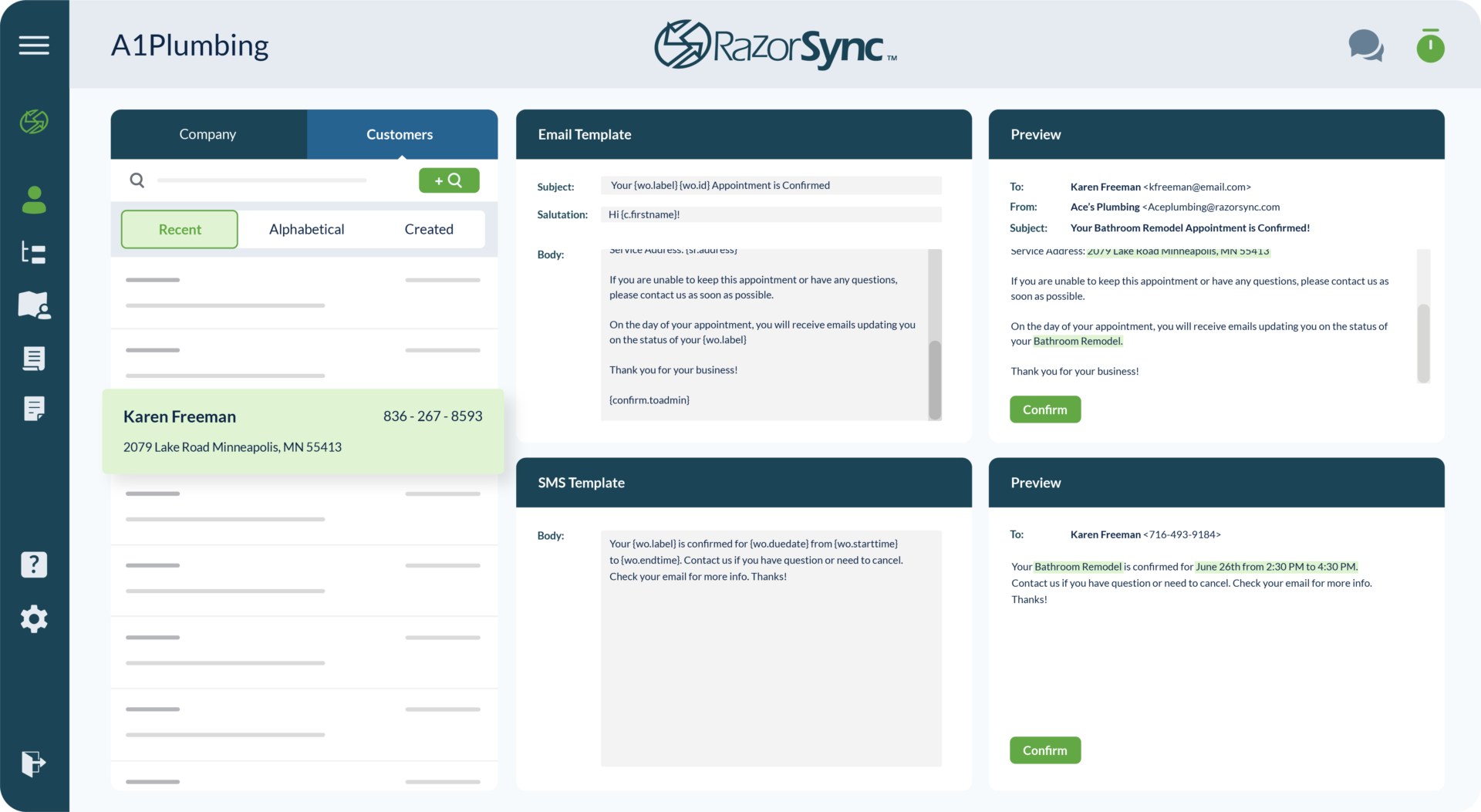

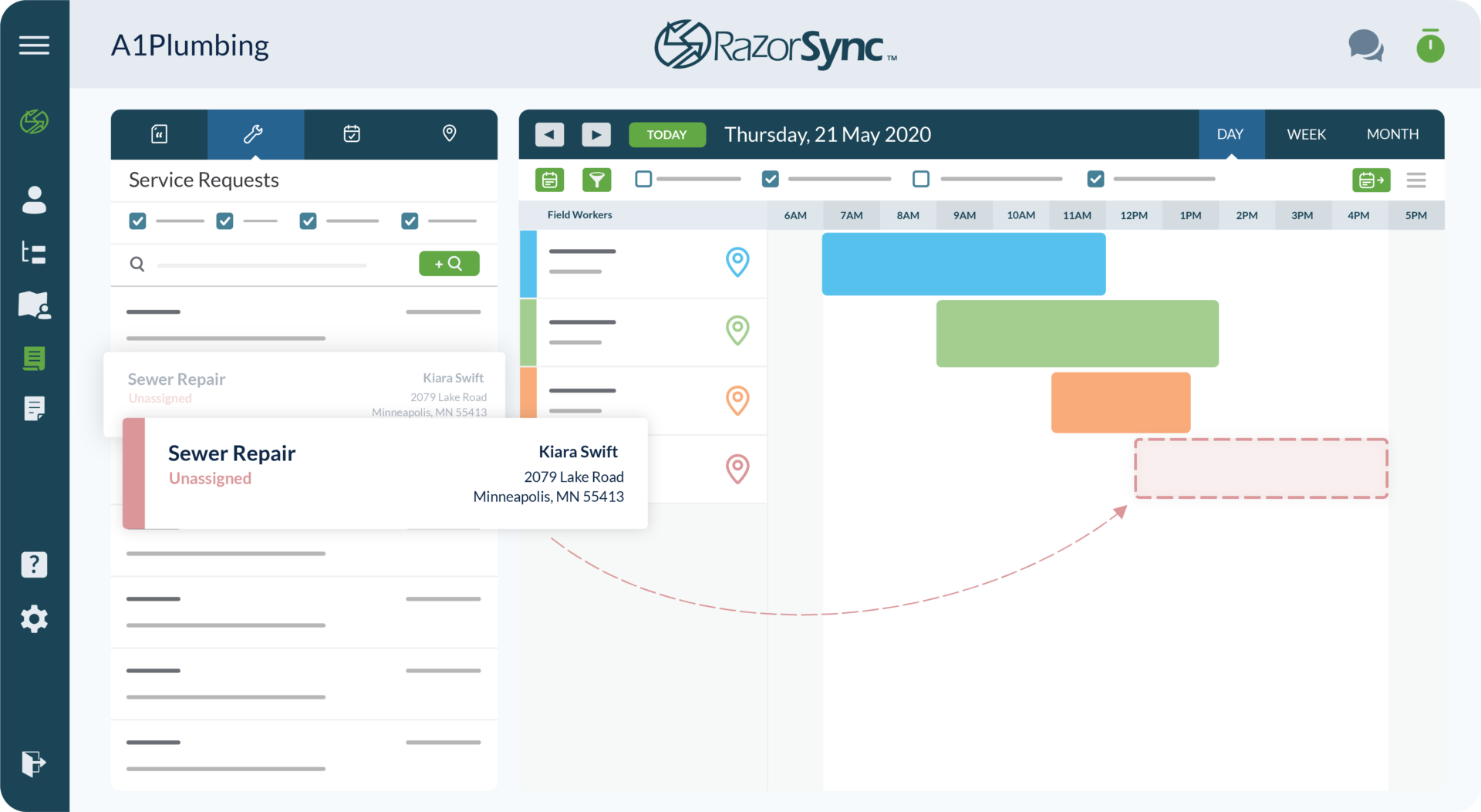

Keep good records, year-round

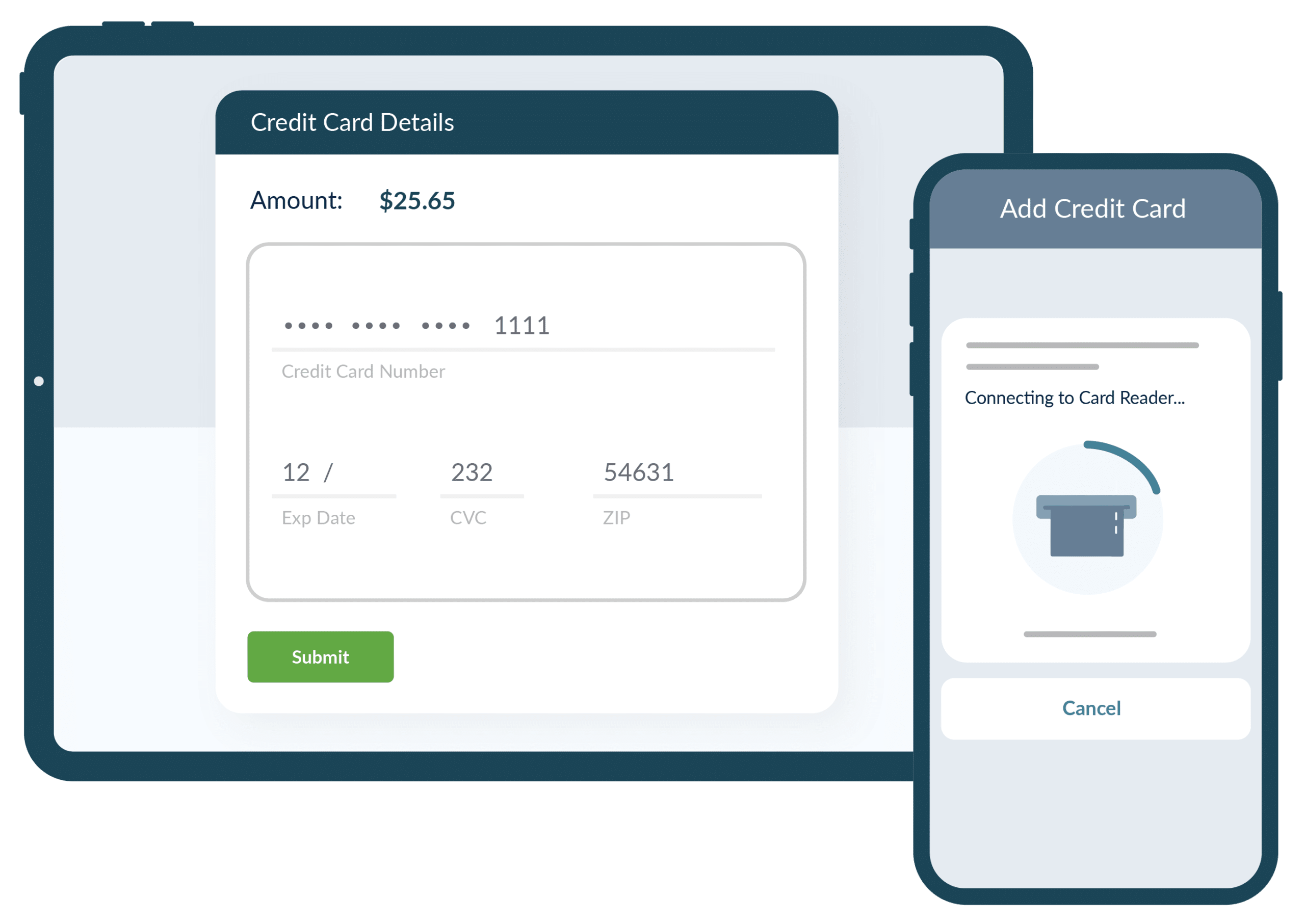

Be ready to provide your accountant with complete records of inventory on hand, the cost of parts, payroll, and overhead. There are good software solutions that will help you keep records at your fingertips. As a service business, you will benefit from a mobile software solution that allows your technicians and estimators to update records from the field and seamlessly integrates with QuickBooks or another accounting software. Ask your accountant when electronic records are sufficient and when you need to keep the paper. If your records are stored electronically, they should be backed up by a cloud-based service.

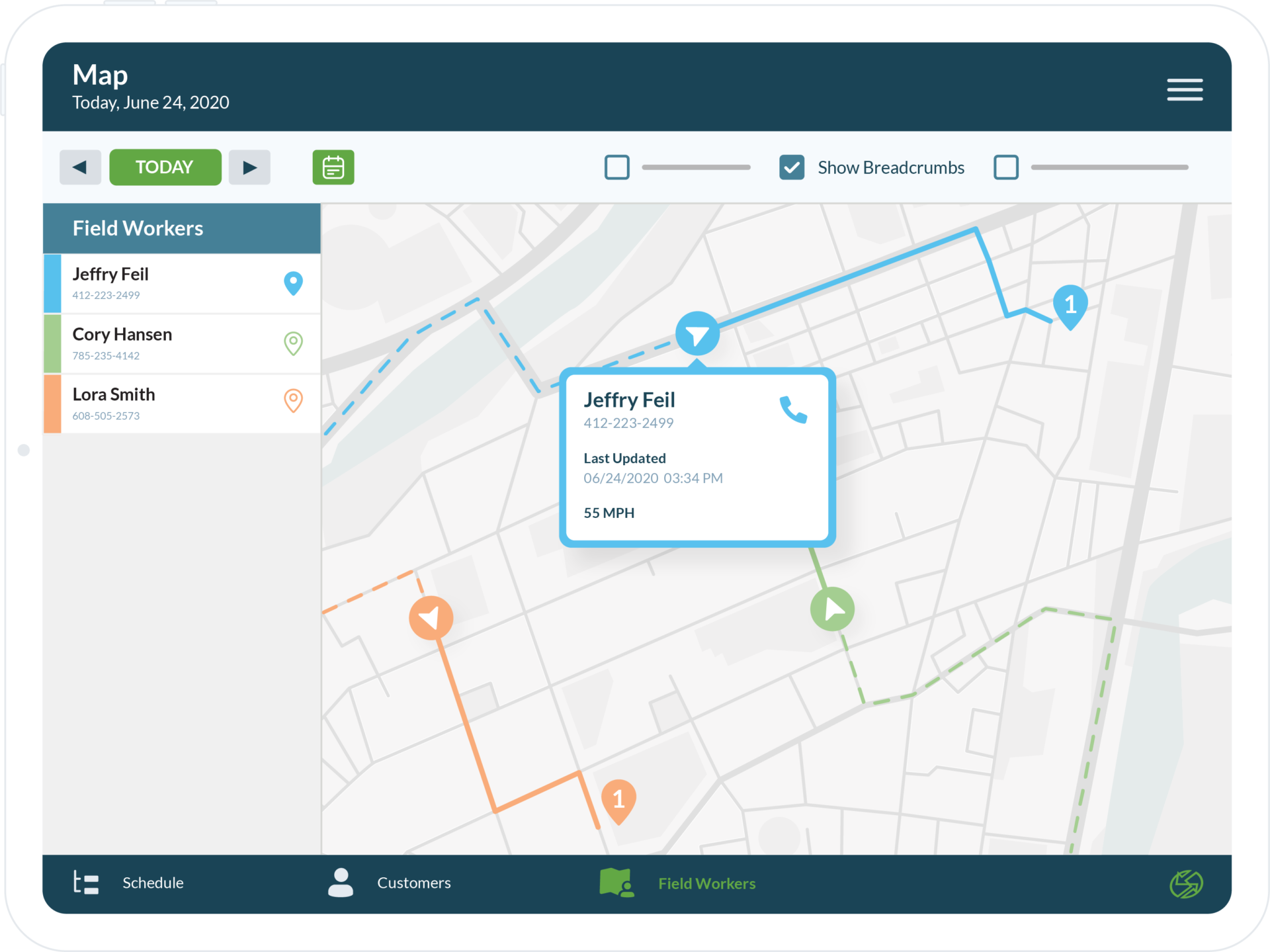

Be Clear About Business Cell Phones

If you are managing a field service business, your cell phone and those you provide for your employees are critical business tools. Be sure to understand and clarify for employees under what circumstances cell phones could be taxed as a benefit. The key is keeping business and personal use separate, even if it means an employee carries two phones. The law regarding a depreciation write-off has changed recently, so be sure you discuss the implications with your accountant, as well as how to expense a mobile field management software service.

Do You Qualify for Health Care Tax Credits?

Under the Affordable Care Act, you may be eligible for tax credits to pay a substantial percentage of your employee health insurance premiums. Your accountant and insurance agent should both advise you on how offering employee health care benefits will affect your taxes.

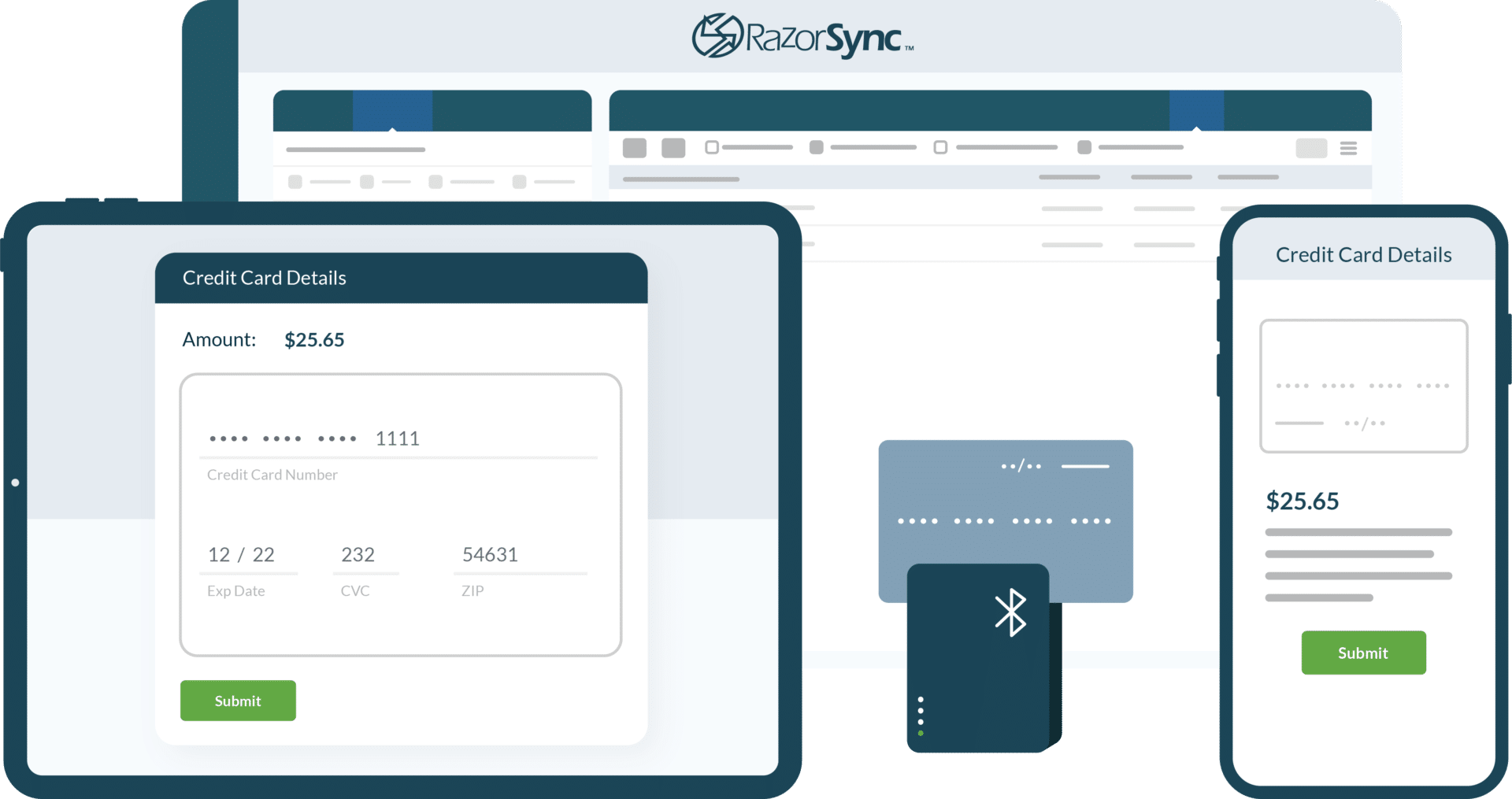

Do You Pay Out-of-Pocket for Business Expenses?

It is not unusual for a small business owner to incur out-of-pocket expenses that can legitimately be deducted as business expenses. However, record-keeping is critical, and some expenses should be submitted to the business for reimbursement rather than deducted from your personal return. Discuss this with your accountant.