Still taking Venmo? How Integrated Payment Software Will Improve Your Field Service Business Process

Making the switch to integrated payment software is the next major business process improvement for your field service company. Integrated payment software eases the payment...

Aug 02, 2021

# of Minutes to Read

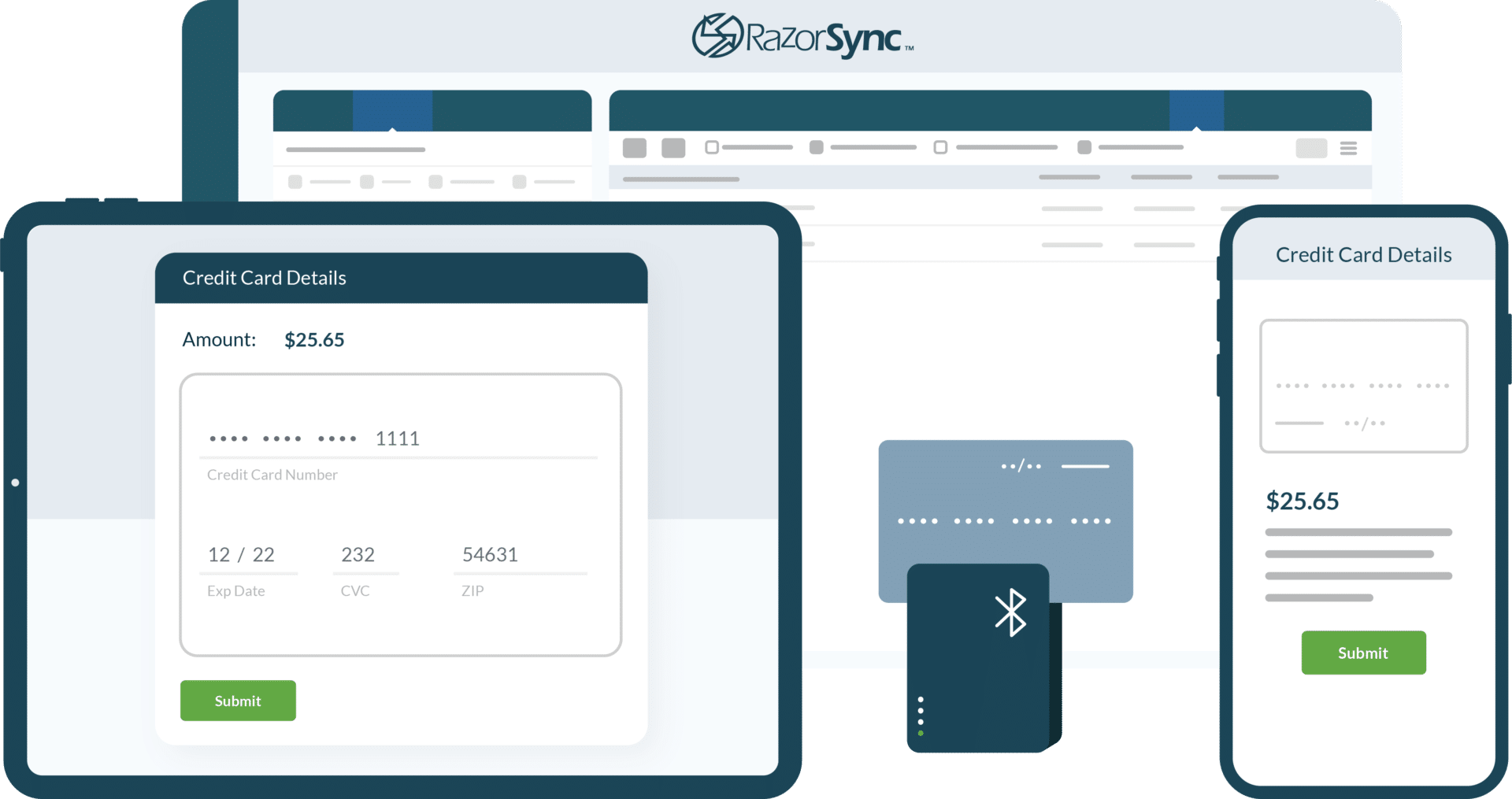

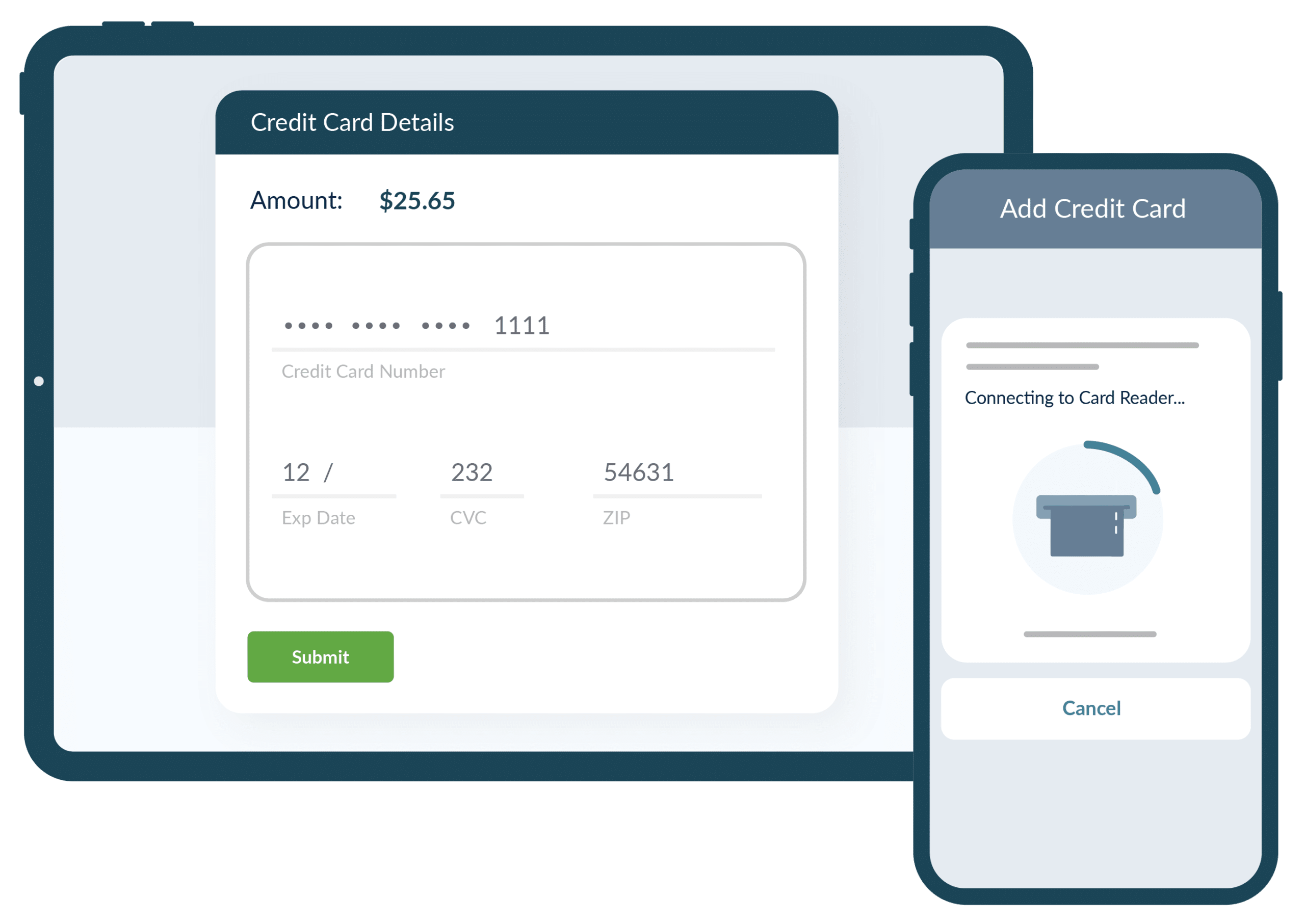

Making the switch to integrated payment software is the next major business process improvement for your field service company. Integrated payment software eases the payment process on the business side. Primarily, it automates the process by connecting payment cards to the accounting software rather than manually inputting information. Field service businesses can create efficiency within their business by switching to integrated payment software.

Why does your field service business need integrated payment software?

It saves time

Without the automation of integrated payment software, payment and invoicing is a massive headache. First, an individual’s credit card number is manually entered into the system. Afterward, an invoice is printed, which is later paired with its respective electronic invoices, and the balance sheet is modified accordingly. This tedious process is completed by a company employee whose time and energy could be channeled elsewhere to boost overall productivity. Plus, any human mistakes made by an employee must be corrected and therefore cost time and money for the business.

It saves money

Implementing integrated payment software as a business process improvement saves your field service company money. The cost associated with the lengthy amounts of time employees spend manually balancing payments is significant. Automating the process will save your business money in the long run. In fact, standard accounting practices can result in your business receiving payments late due to the duration of the task.

It prevents errors

Not only will an integrated payment system cause tremendous business process improvement by saving time, but it will also prevent potential errors. When an individual is in charge of significant data entry each day, there is a huge chance they will make at least one error. Integrated software smoothes the payment process by automating it and not involving a third party in the payment process. These preventative measures lead to overall business process improvement.

It maximizes security

Payment security is extremely important, especially in a world filled with hackers and thieves. If a business experiences a security breach, they run the risk of losing everything. Integrated payment software systems include technology that heightens company security measures, such as end-to-end encryption and PCI-compliant cloud-based payment systems. When dealing with money and clients, security must be a top priority. Integrated software systems will ensure that field service businesses effectively protect their money and security.