Don’t Get Tripped Up By Your Billing Cycle

As a startup, we’re constantly thinking about ways to make our employees more efficient. In a time when businesses need to be leaner and more...

May 01, 2018

# of Minutes to Read

As a startup, we’re constantly thinking about ways to make our employees more efficient. In a time when businesses need to be leaner and more prudent with their assets, the last thing you want to do with your time- the most valuable resource you have- is use it to focus on billing the customer.

The old adage of “if it’s not broken, don’t fix it” is probably the first thing that comes to mind when you read an article like this one. You’ve got a process, it works, and it doesn’t involve automating anything. You simply draft a paper invoice, collect the payment in the field, and bring the payment and the invoice back to the office for processing by your accountant or one of your Operation Managers.

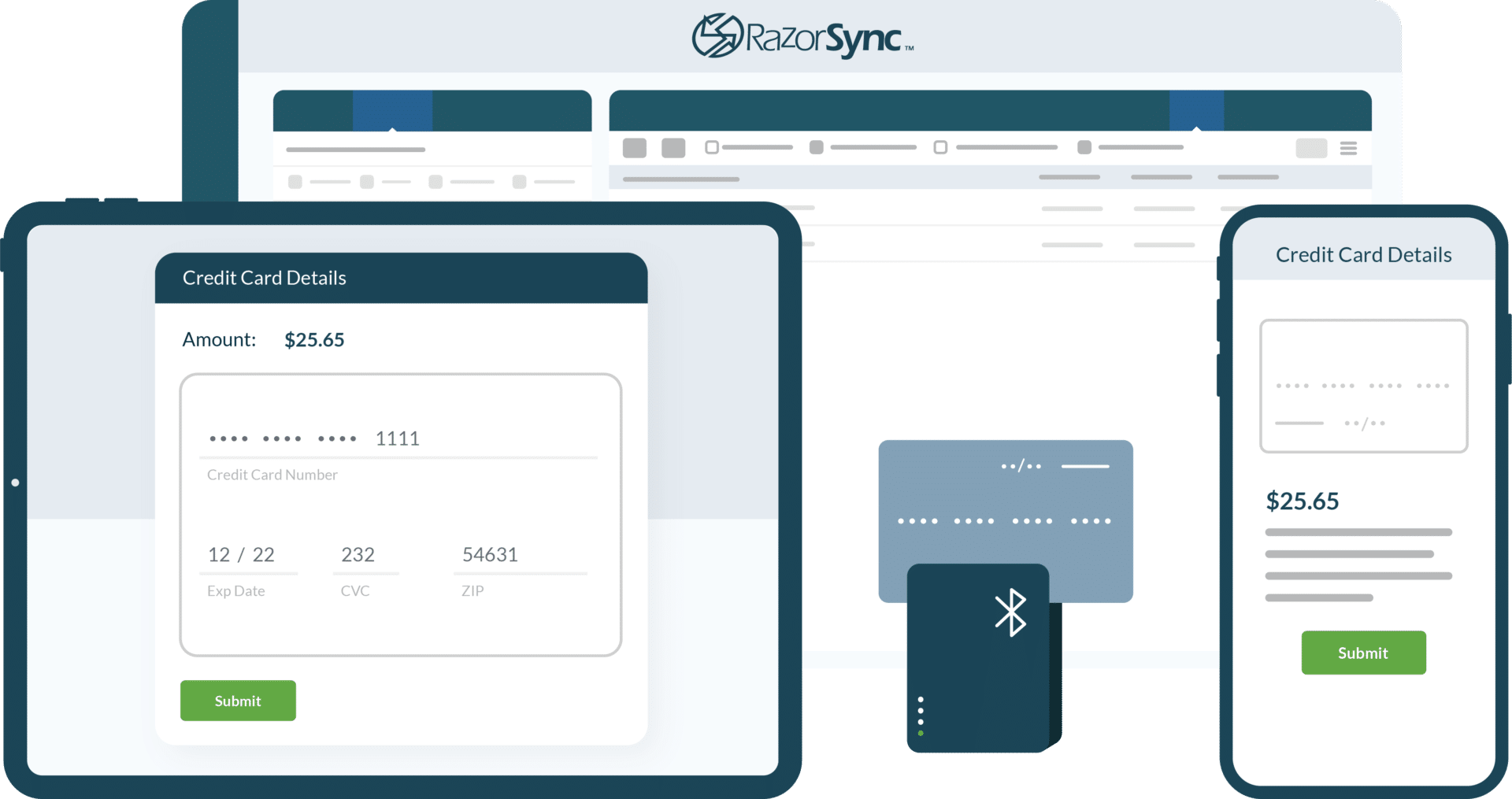

If this doesn’t describe your process, then maybe you’re a company who focuses on the monthly recurring revenue and maybe you don’t leave paper invoices but your billing process consists of you or one of your managers sitting in the office well after everyone else has left, having to find all of your customers who are on a net 30, or a net 60 payment plan. After you’ve found (or so you think) all of their invoices that are due and you’ve manually run the payments for their past due amounts, you get to go home and wait for it to start all over again next week. I’ll take this one step further and maybe you’re still using paper to keep track of the credit card you need to use to bill them (a big no-no in the PCI compliant world, and a very costly mistake).

Regardless of whether or not you can fit your business into one of these buckets, keep reading…

These processes may work when you’re running 3 – 6 technicians in the field and you have around 300 consistent customers you do business with. Maybe that’s all YOU’RE looking to do with your business, and we can certainly respect that, but what happens when the word gets out that you’re one of the few who provides reliable and quality service?

Here’s what happened to us. In 2015, our staff primarily consisted of an engineering team, a small sales/marketing team, and an even smaller support team. We were running a million miles an hour and we did things because they worked, not because they were best practices. Part of the “because it worked” process required us to manually modify each customer’s bill who was cut a “deal” (I’ll talk more about deal cutting later) which forced us to modify their total billable amount (TBA) before we could complete the cycle by using our automated payment processing system.

It worked; it wasn’t ideal – and it could take anywhere from 24 hours to 3 days to complete with a lot of double entry (shoot me now). One of the biggest side effects from running a MacGyvered billing process was– more often than not– we ended up fielding angry calls from customers about how we billed them incorrectly and we needed to fix it (and we did).

The week of billing turned every inbound phone call into a ticking time bomb. Any call could have a miffed customer on the other end of the phone – and the worst thing in the support world is answering the phone to a frustrated customer that is absolutely in the right. This led us to lose hard-fought-to-win customers, issue credits, as well as offering more services free of charge to improve the relationship.

What came out of this was the creation of an automated billing system that our Sales staff could use – so in the (rare) event a deal was cut, it was documented on the spot; the total amount and when the customer would be billed was communicated from our Account Executives to the customer leaving no room for confusion, and finally no more manual data entry. Today our billing cycle takes us 2 hours to complete.

One thing we learned was that you can do everything perfectly, from taking the inbound call to performing the service. But if you mess things up right at the end, the only thing your customer will remember is that these chuckleheads don’t know their heads from their bricklayers.

By now, you’re probably saying – that’s great…. What does this mean for me?

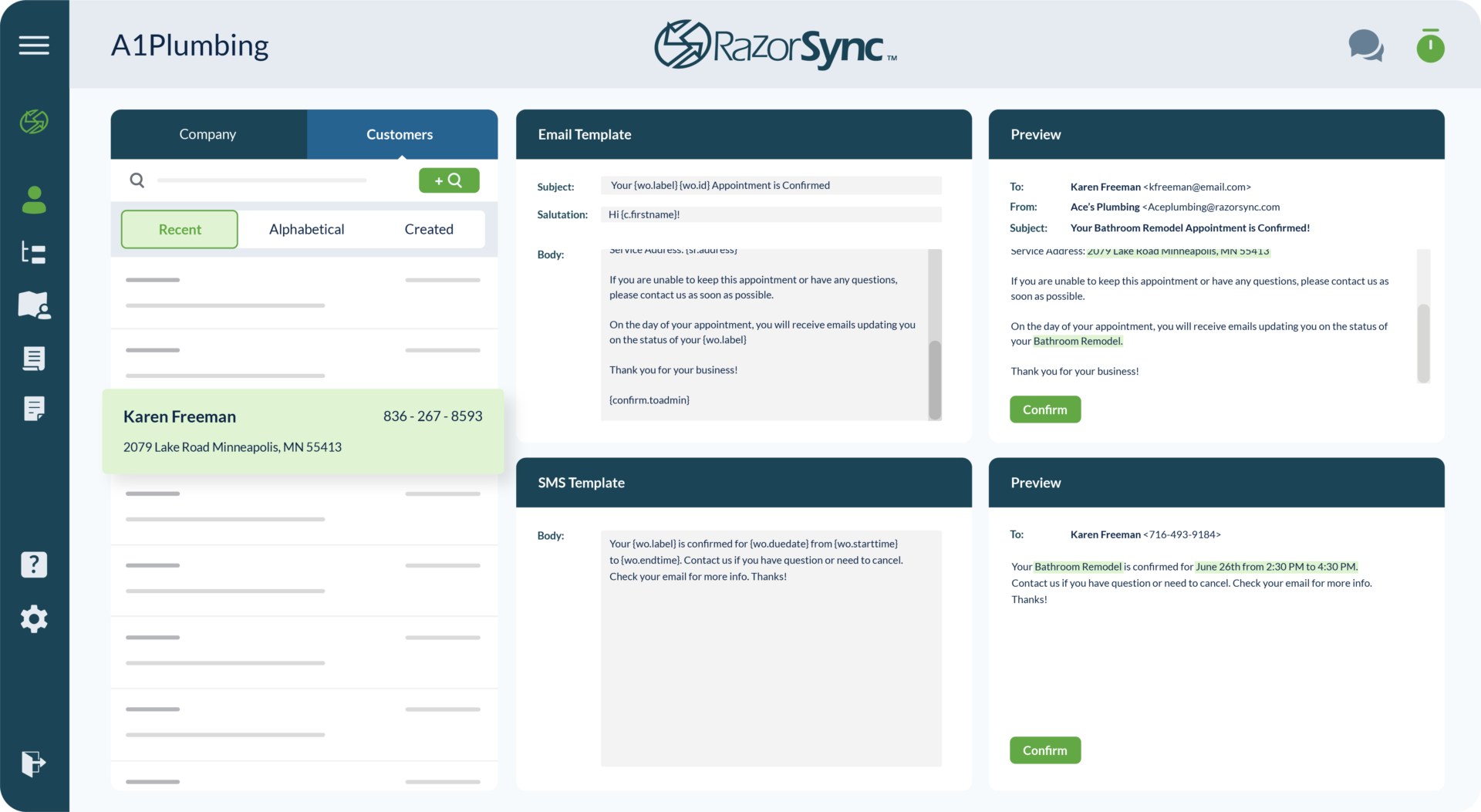

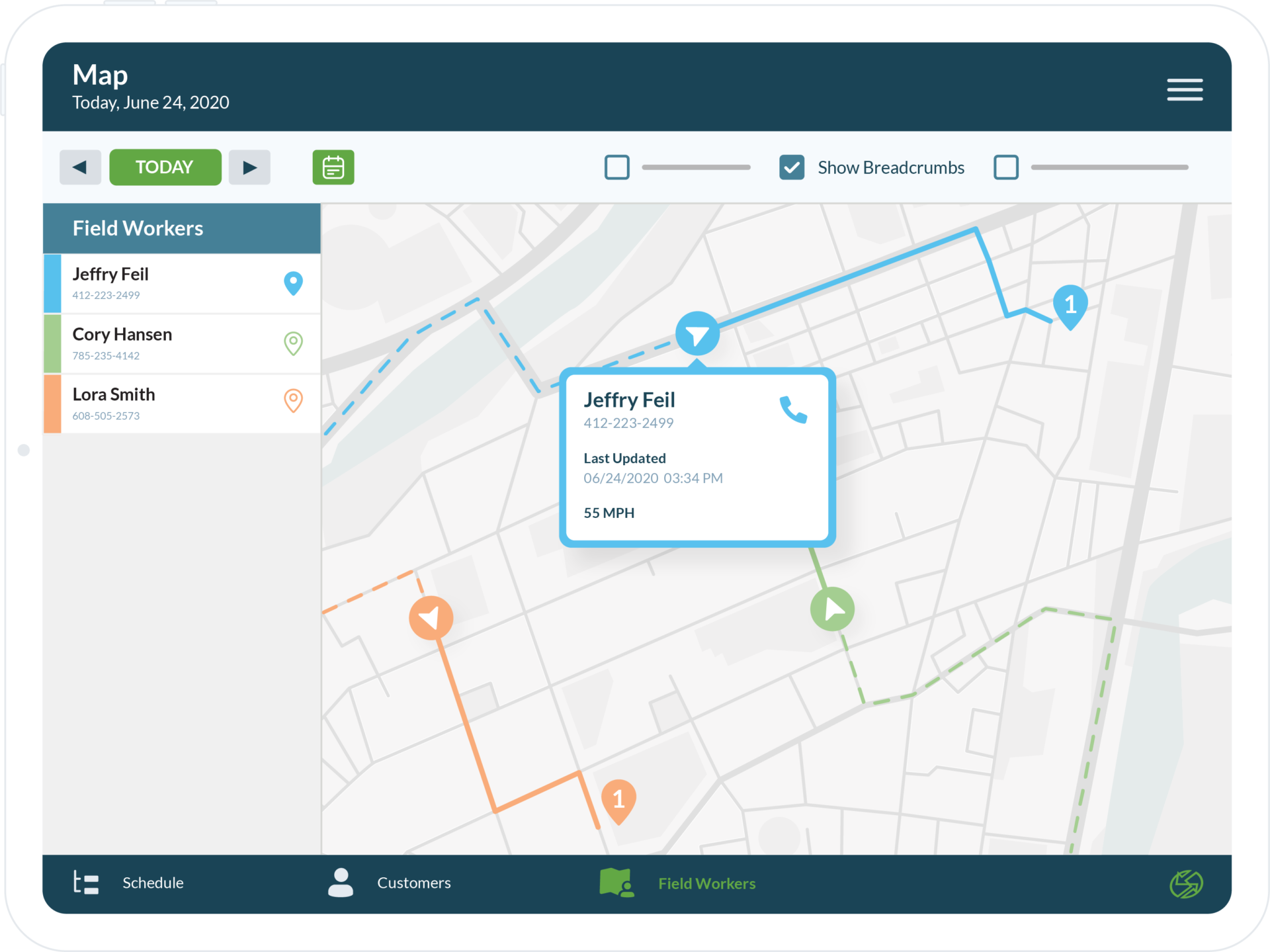

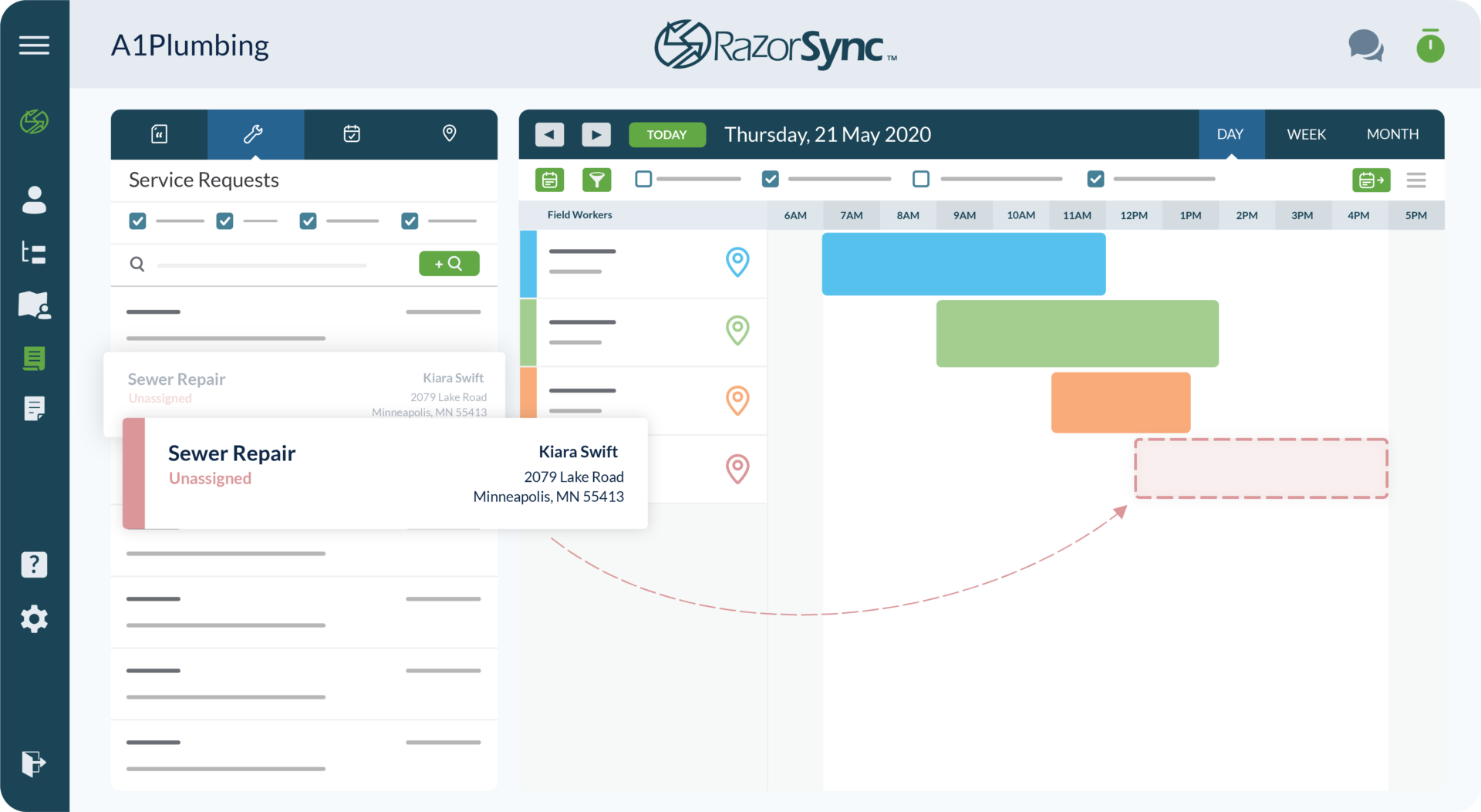

If you operate a business, you need to make sure that you have clear lines of communication throughout your business. You need to know that any process you follow is easily repeatable. And when it comes to billing it means making sure that you’ve battened down the hatches between the field (sales/technicians) and the office (admins/billing).

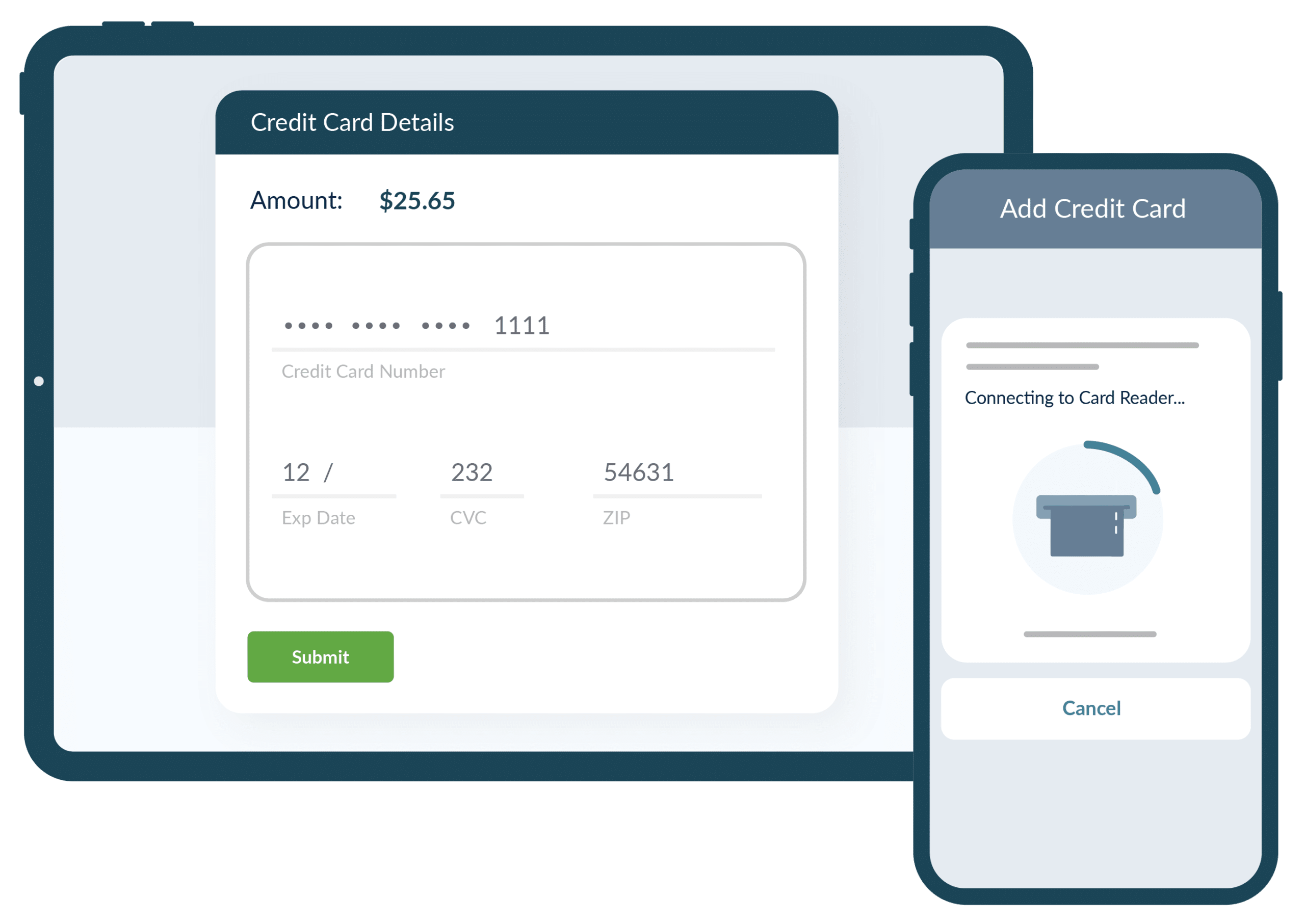

If you’re a service company with operators in the field, you’ll need a solution that incorporates the ability to invoice, accept credit card payments, place cards on file for future billing, and modify the billing cycle either system-wide or for a specific customer – all of this ideally can be done from the field. Finally the real winner here is being able to set up your system to bill credit cards on file for customers whose invoices are past due automatically. Believe it when you see it?

Start a free trial, where seeing, becomes believing.